Entering the world of apartment building investments can be a game-changer for your financial portfolio. But how can beginners ensure they're making the right moves from the start?

Jeff Rose, CFP® Jeff Rose, CFP® is a Certified Financial Planner™, founder of Good Financial Cents, and author of the personal finance. Read More

The GFC® Money Expert Review Board The GFC® Money Expert Review Board is a team of financial experts who provide independent, unbiased reviews of financial products. Read More

Advertising Disclosure GoodFinancialCents® has an advertising relationship with the companies included on this page. All of our content is based on objective analysis, and the opinions are our own. For more information, please check out our full disclaimer and complete list of partners.

Quality VerifiedGoodFinancialCents® partners with outside experts to ensure we are providing accurate financial content.

These reviewers are industry leaders and professional writers who regularly contribute to reputable publications such as the Wall Street Journal and The New York Times.

Our expert reviewers review our articles and recommend changes to ensure we are upholding our high standards for accuracy and professionalism.

Our expert reviewers hold advanced degrees and certifications and have years of experience with personal finances, retirement planning and investments.

Why You Can Trust GoodFinancialCents®GoodFinancialCents® partners with outside experts to ensure we are providing accurate financial content.

These reviewers are industry leaders and professional writers who regularly contribute to reputable publications such as the Wall Street Journal and The New York Times.

Our expert reviewers review our articles and recommend changes to ensure we are upholding our high standards for accuracy and professionalism.

Our expert reviewers hold advanced degrees and certifications and have years of experience with personal finances, retirement planning and investments.

Investing in real estate can be lucrative and a great way to diversify your portfolio. With inflation soaring, many investors are turning to different real estate investments to increase their income.

When it comes to real estate investing, there are several directions that you can go. Most new real estate investors will turn to simple single-family homes to get started before they look into anything too complex. However, if you want to maximize your real estate earnings, you might consider investing in apartment buildings.

In this article, we’ll look at how to invest in apartment buildings so you can determine if it’s an investment decision you’ll want to make. And if you don’t have millions of dollars in capital sitting around, don’t stress—we have options for everyone with varying budgets and investing experience levels.

When investing your money, you want the highest returns possible while minimizing risk so as not to waste time or energy. You’ll notice more potential for higher profits as you learn how to invest in apartment buildings.

These are six different ways to invest in apartment buildings if you’re new to the space. Your choice will ultimately come down to what’s comfortable based on your circumstances and goals.

There are three crucial factors to consider before deciding how to invest in an apartment building:

Let’s take a closer look at how to invest in apartment buildings.

You can research and begin investing by purchasing an apartment building as a solo investor. While this may be the most intimidating option, the good news is that you can keep all the profit to yourself.

The most important thing to remember when investing on your own is that all of the responsibility will fall on you. You’ll be on the hook for maintenance work, tenant conflicts, collecting payments, and other tasks. It’s helpful to have several reputable real estate contacts to hire as help for legal, financial, or maintenance concerns.

When you own the apartments you stand to make more of the profit but that also means you’re on the hook for everything else.

On the plus side, buying an apartment building on your own means you get to keep all of the profits, and you can implement your vision for the property. You can also write off many of your property-related expenses on your taxes.

It’s essential to find a real estate lawyer you can trust to help you go through these documents and answer your questions.

We asked Daniel Shin of The Darwinian Doctor for advice on how to invest in apartment buildings, and here’s what he had to say:

The next option is to find a partner for the investment, so you’re not managing risk alone or stuck with all the work. Finding the right partner can help you speed up the process and split the responsibilities—that way, you don’t become as overwhelmed.

There are many different ways to go about finding a partner. There are real estate investors who actively seek out partners, and there are people who just ask the contacts in their social network.

If you’re not quite sure how to find a great real estate partner, here are a few other options you can try:

It’s important to highlight the pros and cons of any investment, so you’re aware of what you’re getting into.

We spoke with one real estate investor who shared the negatives of buying an apartment building with a partner. Tom Brickman, the author of The Frugal Gay blog, shared his insights on investing with a partner:

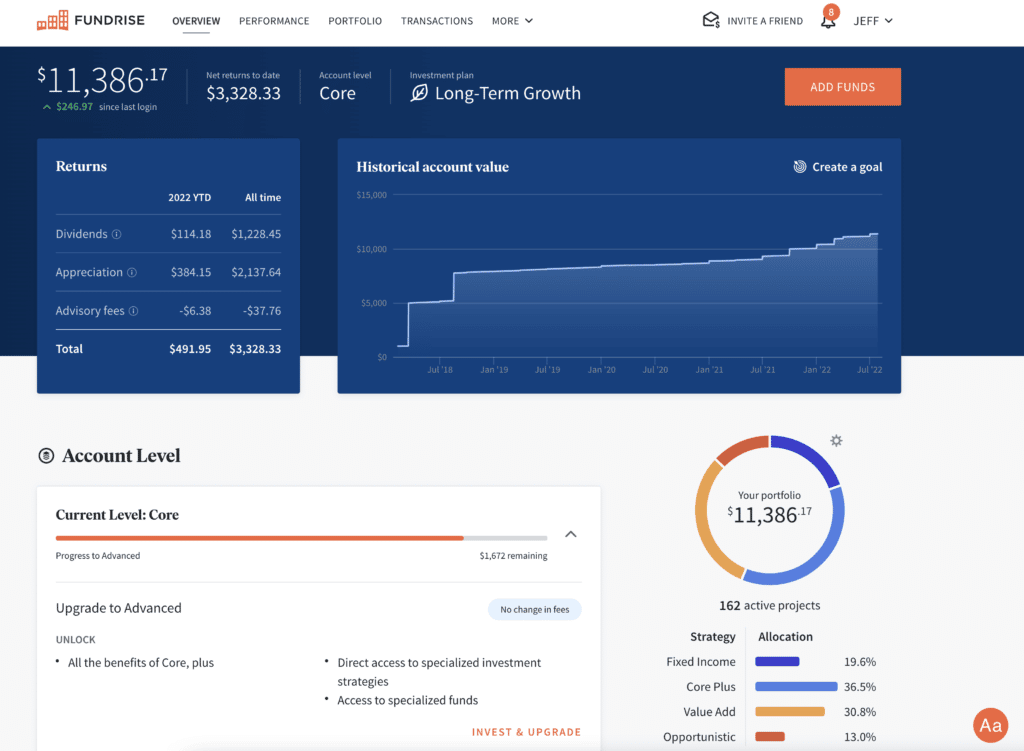

Fundrise makes it easy for anyone to become a real estate investor because they have low minimums to get started and are open to any investor, no matter their experience. It also has a user-friendly website where users can choose the ideal portfolio based on their budget.

While investing in an apartment building can be a healthy option for diversifying your portfolio and a decent hedge against inflation, it comes with extensive work that you may not have time for.

If you’re not sure that you’re ready for the responsibility of investing in an apartment building as a property owner, you can always invest in a REIT (Real Estate Investment Trust). REITs are companies that own, operate, or provide financing for income-generating real estate projects.

REITs are most passive way to invest in apartment buildings.

REITs have made real estate investing more straightforward and accessible to investors with varying budgets. They’re also passive investments that don’t require any effort on your behalf—meaning you won’t have to worry about screening tenants or collecting rent.

Many REITs are publicly traded on the stock market, meaning you can invest when you’re ready from the comfort of your own home. You can use online brokers to invest in these REITs at any time.

Fundrise offers REIT options as well as crowdfunded real estate agreements. While your standard REIT can be publicly or privately traded, Fundrise REITs are private, tend to cover various property types, and often require much less upfront capital.

Fundrise also offers preset investment portfolios, depending on your goals.

A real estate fund is a mutual fund that invests in REITs and real estate companies. To invest specifically in apartment buildings, you must seek real estate mutual funds that invest in REITs or companies specializing in multi-family units.

There are three types of real estate funds:

| Fund Name | Fund Type | Ticker Symbol | Morningstar Rating |

|---|---|---|---|

| DFA Real Estate Securities I | Mutual Fund | DFREX | Gold |

| Principal Global Real Estate Sec Instl | Mutual Fund | POSIX | Silver |

| Fidelity Real Estate Income | Mutual Fund | FRIFX | Silver |

| Cohen & Steers Instl Realty Shares | Mutual Fund | CSRIX | Silver |

| Vanguard Real Estate ETF | ETF | VNQ | Gold |

| Schwab US REIT ETF | ETF | SCHH | Silver |

| Vanguard Global ex-US Real Est ETF | ETF | VNQI | Bronze |

| SPDR® Dow Jones Global Real Estate ETF | ETF | RWO | Bronze |

While REITs pay out regular dividends to investors, real estate funds provide their value through appreciation. These funds also offer a healthy amount of diversification to a portfolio, making them less risky than other investments.

Like with any investment, discussing your goals with a financial advisor before making any decisions can be helpful.

But if you’re thinking about investing in apartment buildings, there are many options to choose from. Since there’s an entry point for every budget and expertise level when it comes to real estate investments, almost anyone can have some ownership of a property.