We’ve put some small files called cookies on your device to make our site work.

We’d also like to use analytics cookies. These send information about how our site is used to a service called Google Analytics. We use this information to improve our site.

Let us know if this is OK. We’ll use a cookie to save your choice. You can read more about our cookies before you choose.

Change my preferences I'm OK with analytics cookies

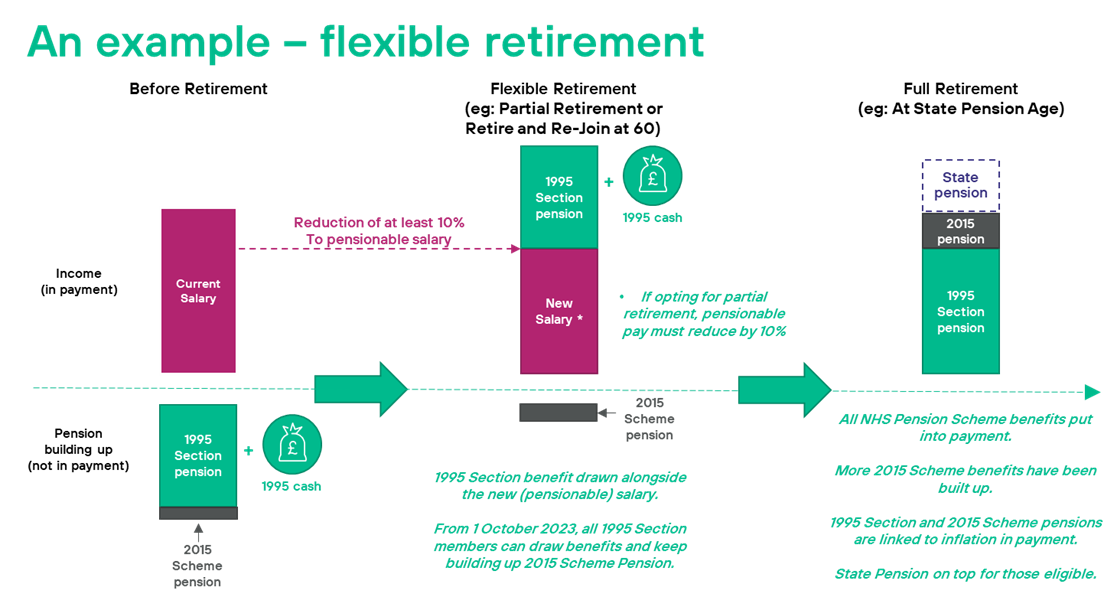

Having a salary coming in each month can give you real peace of mind. What if you could take your pension and top it up with a salary too – that could give you best of both worlds. There are a couple of options available to you.

If you’re not ready to stop work altogether, you can retire and take your full pension, then return to work after a short break and re-join the NHS Pension Scheme to keep building your future pension benefits.

This is called retire and re-join. It’s already available to members in the 2008 Section and 2015 Scheme.

Individuals considering this option should discuss with their line manager the terms on which they will be able to return following retirement. Depending on the circumstances, it may not be possible to return to the same role – which may affect your decision.

With partial retirement you can claim your pension, whilst continuing to work, but without having to take a break and leave your job. It’s already available to members of the 2008 Section and 2015 Scheme and from I October 2023, it is available to members of the 1995 Section, too.

See how flexible retirement could work for you:

| Partially retire at 55 taking 100% of 1995 benefits: | £13,348 a year for life | Lump sum of £44,449 |

| Reduce hours by 50% and carry on working in the NHS, without taking a break or changing contract, and continue contributing to the pension scheme until age 60 | ||

| Fully retire at 60 taking 100% of 2015 benefits: | An additional £8,239 a year for life | |

Retire and re-join would work very similarly to the example above. The difference would be that the member would need to take a short break and return to work on a new contract. The member could then continue contributing to the NHS Pension Scheme and would build up benefits in the 2015 Scheme.

All flexible working options are subject to agreement with your employer. You can read more about a flexible retirement on the NHS Business Services Authority website.

An extra note on inflation:

During each year of active service, your 2015 Scheme pension is reviewed to keep in line with the rise in the cost of living. 2015 Scheme pensions are reviewed using the Consumer Price Index (CPI). This measures how costs of a representative basket of goods and services have changed over time An additional 1.5% is added. This makes sure the value of your pension will be above inflation.

Once you start receiving your pension, your benefits will continue to be reviewed each year to keep up with living costs – it’s called the Pensions Increase.

See below for more detail:

Partial retirement

The member wants to take 100% of their 1995 Section benefits at age 55. The benefits the member may take (accounting for any early payment reductions) are:

| Retire at 55 | 1995 Section |

| Service | 28 |

| Pension | £13,348p.a.* |

| Lump sum | £44,449*** |

The member wants to take 100% of their 2015 Scheme benefits at age 60. The benefits the member may take (accounting for any early payment reductions) are:

| Retire at 60 | 2015 Scheme |

| Service | 12 |

| Pension | £8,239p.a.** |

| Lump sum | – |

* includes early retirement adjustment of 20% at 55.

** includes early retirement adjustment of 30% at 60.

*** includes early retirement adjustment of 11.2% at 55.

Talk to your manager to find out more about your flexible working options.